what percentage of taxes are taken out of paycheck in nc

The Percentage of Taxes Taken out of Paychecks eHow. I am a server in NC and most of the time I.

How Much Should I Set Aside For Taxes 1099

It is 213 an hour.

. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for North Carolina residents only. The Social Security tax is 62 percent of your total pay until you reach an annual income threshold. What is minimum wage for servers in North Carolina 2009.

It is not a substitute for the advice of an accountant or other tax professional. The percentage rate for the Medicare tax. Amount taken out of an average biweekly paycheck.

Add up all your tax payments and divide this amount by your gross pay to determine the percentage of tax you pay. What is the percentage of federal taxes taken out of a paycheck 2020. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any. The state of North Carolina has an income tax rate of 549 percent for the 2018 tax year. North Carolina income tax rate.

10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. The North Carolina Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and North Carolina State Income Tax Rates and Thresholds in 2022. There is no income limit on Medicare taxes.

Total income taxes paid. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. The North Carolina bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

These amounts are paid by both employees and employers. Number of exemptions claimed local or municipal taxes etc. North Carolina Hourly Paycheck Calculator.

What percentage is taken out of paycheck. The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any. What percentage does NC take out for taxes.

Divide this number by the gross pay to determine the percentage of taxes taken out of a. What percentage is taken out of your paycheck for taxes. For example if your pay is more than 209 but not more than 721 your employer will multiply your pay by 15 percent and add 1680 to the result to determine your tax withholding.

FICA taxes consist of Social Security and Medicare taxes. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for North Carolina residents only. Almost everyone who works for a paycheck has taxes deducted each payday.

The total bill would be about 6800 about 14 of your taxable income even though youre in the 22 bracket. For example if your gross pay is 4000 and your total tax payments are 1250 then your percentage tax. The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks.

The IRS recently added a new Withholding Calculator to their website and encourages all employees to use the calculator to perform a quick paycheck checkup. This North Carolina hourly paycheck calculator is perfect for those who are paid on an hourly basis. 525 Every taxpayer in North Carolina will pay 525 of their taxable income for state taxes.

There is a flat income tax rate of 499 which means no matter who you are or how much you make this is the rate that will be deducted. That 14 is called your effective tax. Switch to North Carolina salary calculator.

Amount taken out of an average biweekly paycheck. Calculate the sum of all assessed taxes including Social Security Medicare and federal and state withholding information found on a W-4. Social Security tax and Medicare tax are two federal taxes deducted from your paycheck.

It is not a substitute for the advice of an accountant or other tax professional. What is the percentage of federal taxes taken out of a paycheck 2020. New Federal Tax Withholding Tables were added to the Integrated HR-Payroll System last month and many of you are wondering if you need to change your withholding allowance.

North Carolina payroll taxes are as easy as a walk along the outer banks. For 2021 employees will pay 62 in Social Security on the first 142800 of wages. Details of the personal income tax rates used in the 2022 North Carolina State Calculator are published.

North Carolina has not always had a flat income tax rate though. The federal income tax has seven tax rates for 2020. The federal income tax has seven tax rates for 2020.

If you make more than a certain amount youll be on the hook for an extra 09 in Medicare taxes. FICA taxes are commonly called the payroll tax however they dont include all taxes related to payroll. 27 rows North Carolina Paycheck Quick Facts.

He will take the taxable amount of your pay multiply it by a certain percentage and add a base amount. 145 of each of your paychecks is withheld for Medicare taxes and your employer contributes another 145.

North Carolina Income Tax Calculator Smartasset

Estheticians Salary In Charlotte Nc Comparably

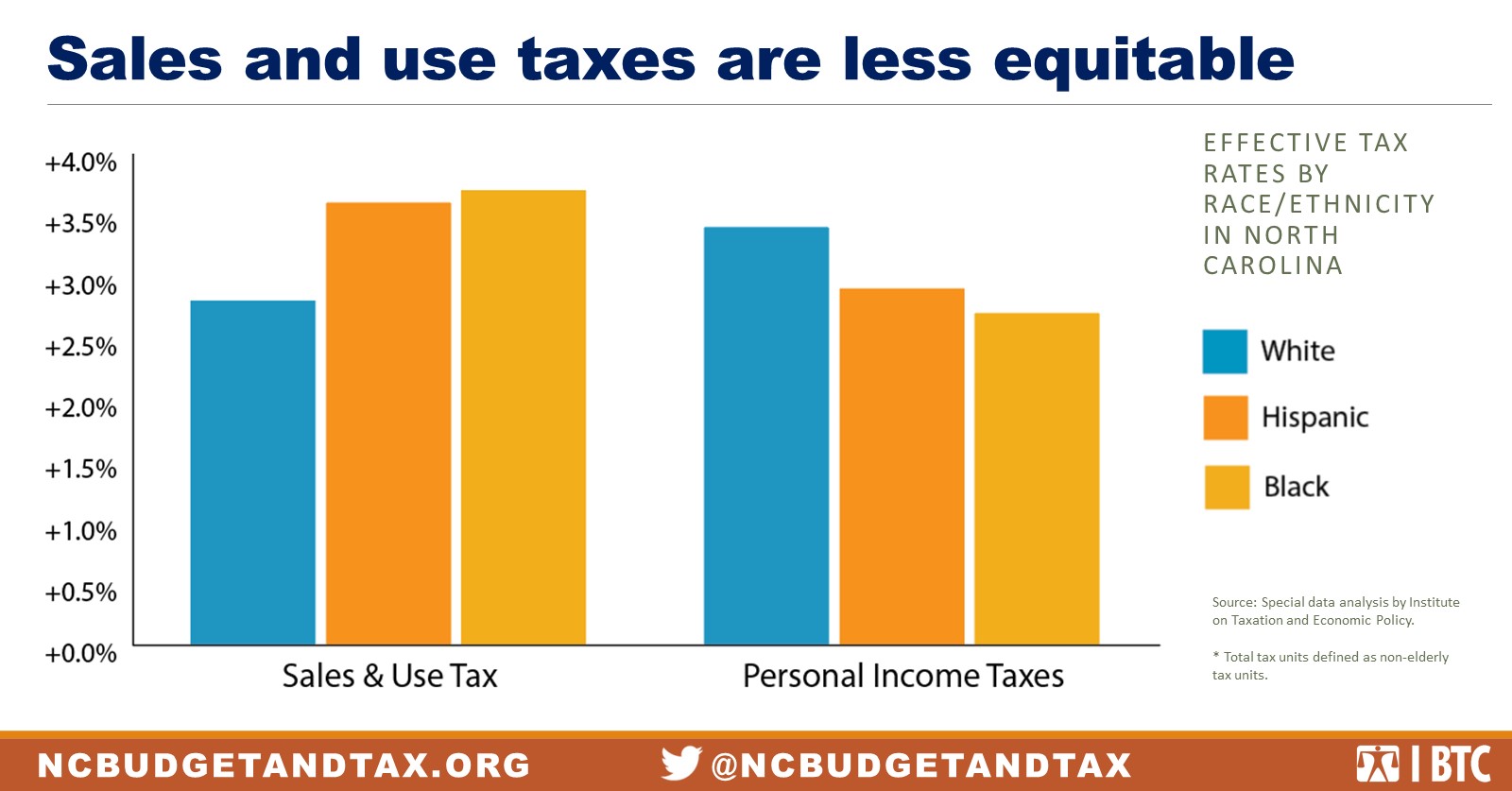

State Tax Policy Is Not Race Neutral North Carolina Justice Center

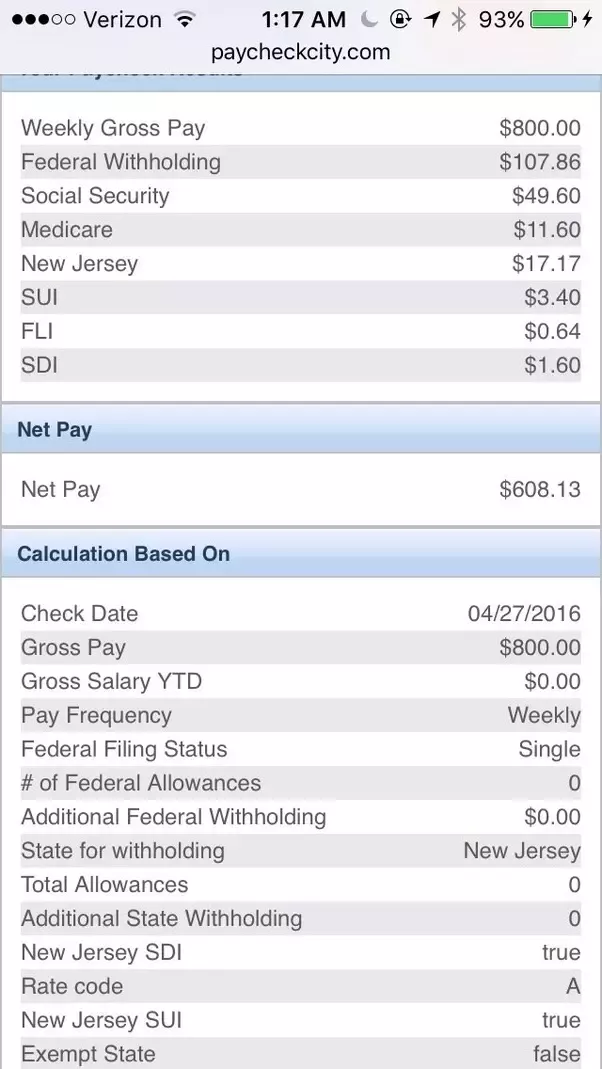

I Make 800 A Week How Much Will That Be After Taxes Quora

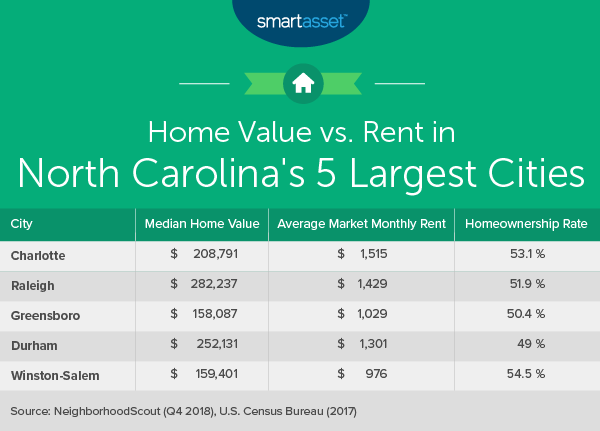

The Cost Of Living In North Carolina Smartasset

North Carolina Paycheck Calculator Smartasset

State Income Tax Rates And Brackets 2022 Tax Foundation

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Paycheck Calculator North Carolina Nc Hourly Salary

Tax Withholding For Pensions And Social Security Sensible Money

New Tax Law Take Home Pay Calculator For 75 000 Salary

How Much Tax Is Deducted From A Paycheck In Nc

North Carolina Income Tax Calculator Smartasset

North Carolina Paycheck Calculator Smartasset

New Tax Code Impacts Lottery Prizes

Free Online Paycheck Calculator Calculate Take Home Pay 2022

2022 Federal State Payroll Tax Rates For Employers

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities